2022Q3 Quarterly Client Newsletter

Dear Clients,

This past quarter we saw the same market dynamics play out that we saw in the first half of the year. The market is still down 25% for the year (although it has gone up some after the date your statements were printed). The market direction is still dominated by inflation, interest rates, and recession concerns. So, let’s address each of these.

Inflation

Let’s discuss inflation first, since it has the most direct effect on your everyday life. In a few previous newsletters I’ve talked about some signs that inflation is beginning to come down and described it like seeing the light at the end of the tunnel. Now, however, it appears we are not moving through the tunnel at the speed of a regular train. We are moving at the speed of a horse drawn wagon.

For example, although we’ve seen wholesale used car prices, which are a significant component of inflation, come down, the price decreases have yet to make their way to the end retail prices that consumers pay. We’ve also seen signs of inflation moderating in areas like new rents. It will take some time, however, for new, lower rental rates to make it into official inflation measures. Also, price decreases in other areas like electronics and gas are being offset by price increases in food.

In 2021 and the beginning of 2022, we saw the worst parts of inflation with prices going up and the rate of inflation rising (meaning prices rose 3%, then 5%, then 7%). Right now, inflation is still high but the rate of growth is stable (that is, it’s not growing at an increasing rate).

We would expect some of the declines we’ve seen with wholesale prices and an increase in inventory at some companies to start making their way into the official inflation measures soon.

Interest Rates

In response to inflation, the Fed has raised interest rates to 3.25% and is widely expected to raise rates another 75bps to 4% at the November meeting. Rates are ultimately projected to reach around 5% in 2023.

The market’s big fear is that the Fed will continue to hike rates to slow the economy and cause a recession. The truth is, outside of real estate and auto loans, interest rates do not have a big effect on the economy. While raising rates to absurd levels like 20% in the early 1980s certainly could cause economic harm, as long as interest rates remain somewhere around reasonable levels it’s unlikely to have a large enough impact to cause a major economic slowdown.

Economy

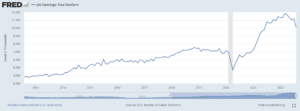

Indeed, the Fed has raised rates from 0% up to 3%, and we’ve not seen much of an effect in the economy and labor market. Job openings are still well above pre-pandemic levels, despite most of the workforce being back to work.

People are still quitting their jobs at high rates. (Workers tend to be willing only to quit jobs for different ones when the labor market is strong.)

The Employment-to-prime-age-population ratio and recent job growth are both nearing their pre-pandemic trends.

What To Do

Altogether there just isn’t much cause for fear on the horizon. Concern, sure, but not fear. We may get a normal, business cycle-type mild recession but certainly nothing along the lines of 2008.

It can definitely be frustrating to see account balances fall, especially as each month this year it seems like they kept getting lower. Human psychology is predisposed toward extrapolating recent events into future, and the temptation is to assume things will continue as they are. There can be a tendency to think that if the market is down now and we have a recession, that the market will fall even more significantly. This can be scary considering everyone’s memory of the last recession in 2008.

However, that is not how the market works. It’s important to remember that the market is forward looking. The market is not pricing in current events, it’s pricing in its expectation of future events. Right now, the market is down because it is expecting a recession of some kind in the future. Likewise, the market will begin to rise when it believes there will be no recession (or the recession is ending). If you wait until the recession is over, you’re likely to miss out on most of the gains. There are numerous funds called Tactical Allocation funds that try to do just that. They try to time the ups and downs of the market. Over time, most of these funds barely eke out a positive return. Unfortunately, I’ve also seen other advisors attempt to time the market for their clients. Several clients have had past advisors pursue such a strategy, and invariably those have been some of the worst performing accounts.

For clients that have several years or more until retirement, it’s important to keep in mind that normal business cycle recession and market ups and downs are part of investing. In an average recession, the market goes down about 25% and recovers within a year to 18 months on average.

For clients that are in or near retirement, we keep some of the account balance in cash, short-term bonds or CDs, and have stocks that have appreciated this year (such as defense contractors) available to sell or fund client withdraw needs until the market recovers.

2022 Performance to Date

For 2022 thus far, all market returns have been negative. The US stock market returned almost -25%, Foreign Developed Market stocks were down a bit more at -27% and emerging markets down were 24%.

Bond markets are negative for the year as well, although down less with inflation-protected bonds performing the best.

US Stock Market: -24.8%

Foreign Developed Market: -27.72%

Emerging Markets: -23.99%

US Total Bond Market: -14.50%

International Government Bonds: -12.95%

Investment Grade Corporate Bonds: -16.98%

Inflation Protected Bonds: -11.76%

Real Estate: -29.25%

(All the returns listed are those of the ETFs we use.)

Because all client portfolios are individual, your portfolio will contain a combination of most or all the investments listed as well as others, so its performance will be different. Please see your statement for your exact portfolio details.

Reminder

Although you are all familiar with my investment management and retirement planning services, I want to remind you of the other financial services I offer.

These services are available to clients as part of their comprehensive fee. I work with clients to build monthly budgets, help pick the best credit card offer, and give advice on their existing company retirement plans. Almost anything related to finance or money is something I’m available to help you with. I’ve even helped clients with non-financial things, such as picking out a new car. I enjoy helping clients, so please do not hesitate to give me a call. Shoot me an email or text if there is any way I can be of assistance.

How is Ben Invested?

Here is how my personal portfolio (my SEP IRA at FOLIO Institutional) is positioned for 2022.

My investment breakdown is as follows:

- 31% in our Capital Appreciation Folio

- 32% in our Concentrated Stock Folio

- 31% in our Aggressive Growth ETF Portfolio

- 1% in Real Estate (Vanguard Real Estate Index, VNQ)

- 1% in Emerging Market Stocks (Vanguard Emerging Market Index, VWO)

- 1% in Investment Grade Bonds (Vanguard Total Bond Market Index, BND)

- 1% in Inflation Protected Bonds (Barclays iShares TIPS Index, TIP)

- 1% in Municipal Bonds (iShares S&P National AMT-Free Municipal Bond Index, MUB)

- 1% in International Investment Grade Bonds (Vanguard Intermediate Term International Bond Index, BNDX)

As you can see, I have a stock-heavy portfolio. I believe our strategies for investing offer the best opportunity for long-term wealth creation.

Note: I also have an older IRA account opened during grad school. That account is invested in one stock, Philip Morris International (PM).

Sincerely,

Performance Disclosure:

The performance data presented prior to 2011 represents a composite of all discretionary equity investments in accounts that have been open for at least one year. Any accounts open for less than one year are excluded from the composite performance shown. From time to time, clients have made special requests that SIM hold securities in their accounts that are not included in SIMs recommended equity portfolio, so those investments are excluded from the composite results shown. Performance is calculated using a holding period return formula, reflects the deduction of a management fee of 1% of assets per year, and reflects the reinvestment of capital gains and dividends.

Performance data presented for 2011 and after represents the performance of the model portfolio that client accounts are linked to, reflects the deduction of management fees of 1% of assets per year, and reflects the reinvestment of capital gains and dividends.

The S&P 500 and Dow Jones Developed Market Index are used for comparison purposes and may have a significantly different volatility than the portfolios used for the presentation of SIM’s returns. The term “global stocks” refers to the Vanguard Total World Stock ETF (VT).

A copy of our most recent Form ADV Part 2A and Part 2B is available upon request.