2023Q1 Quarterly Client Newsletter

Dear Clients,

Before getting into our discussion on the current state of the markets and economy I wanted to mention a new investment portfolio option for clients.

Cash Management Accounts

With interests rates the highest they’ve been since the Great Recession it’s now possible to actual earn some return on safe investments. For clients looking for something similar to a money market type account we can now offer investment portfolios in safe, short-term investment such as Treasury bills and notes, brokered CDs (these are FDIC insured CDs bought or sold in the market), or for clients willing to take on some risk investment grade corporate bonds. The fee for this type of account is in-line with money market accounts at .15% per year (or .0375% per quarter).

There are essentially two major advantages for this type of account.

- You can earn slightly more interest, perhaps .5% to 1% over a typical money market account or local bank CDs.

- It can be tailored to your exact situation. For example, perhaps you want something safe but don’t need the money for two years instead of one allowing you to earn a bit more interest. The portfolio can be tailored for whatever your specific cash requirements are.

Market and the Economy

The market has started the year up almost 7.5%, but you’d be forgiven for thinking it was down or flat given the continued volatility, inflation, recession predictions and collapse of Silicon Valley Bank (SVB). In most previous newsletters I’ve discussed inflation and interest rates hikes. There isn’t much new to add to that discussion this quarter, so I want to focus here on the biggest headlines, the collapse of Silicon Valley Bank.

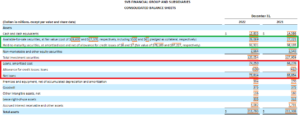

Obviously, the scars of 2008 are still fresh in investors’ minds and the number one question and concern right now is some variation of “Is Silicon Valley Bank (SVB) failing a sign of another 2008 crash coming soon?” The short answer is no. This is not anything like the 2008 financial crisis. The problems at SVB are unique to them and a few other banks that pursued similar strategies. For the visual learners, below is part of SVB’s latest annual balance sheet. Their problems had to do with the two lines item outlined at the top. The 2008 crisis had to do with the area outlined at the bottom.

To understand what happened, we need to review a very simplified version of how bank deposits work and learn about some accounting rules banks must follow.

Banks have to classify their investments as either “available for sale” (abbreviated AFS) or “held-to-maturity” (abbreviate HTM). With AFS investments, banks recognize their profit or loss every day. Think of something similar to logging in to view your account value at the end of each day. Every day at a large bank, they might have customers withdrawing money for payrolls or new loans and other customers making deposits. In short, banks have lots of money moving around so they need some investments that they can buy and sell easily. That’s the purpose of the AFS category.

Banks also tend to have longer term investments. Say you have a bond that matures in three years and you don’t plan on selling. If it’s a Treasury bond where you don’t have to worry about default, then it obviously doesn’t make sense to check your account each day. You’re going to hold the bond for three years, collect your interest payments, and you’ll get your money back when it matures. In a similar way, banks want to do the same thing with similar investments. For this, they can classify some of their investments as HTM. However, there is one big caveat. If the bank wants to sell even a single bond from its HTM investments, it has to re-value all of the investments of that type in the portfolio. When they sell a single Treasury bond, they need to re-value all their Treasury bonds.

In the years prior to COVID, Silicon Valley Bank had half to almost two-thirds of its investments classified as AFS and only one-third to one-half as HTM.

During the COVID years a few things happened. First, the rise of work-from-home and all things tech led to skyrocketing valuations among tech companies. Start-ups did the smart thing, and raised as much money as they could. Second, we had a big influx of cash from the Paycheck Protection Program. Silicon Valley Bank saw enormous amounts of deposit inflows. But there was a problem. Very few customers needed loans, and interest rates were at zero, meaning Treasury and agency mortgage bonds hardly yielded anything.

While other banks (M&T and JP Morgan, for example) just sat on their cash or invested it short-term while they waited for rates to rise, Silicon Valley Bank got greedy. They invested a significant portion in investments that matured in 5-6 years.

As COVID faded and the Fed began returning interest rates to normal, Silicon Valley Bank had a big problem. Their longer-term investment portfolio was starting to show losses and would continue to lose money as the Fed raised rates. To “fix” the problem, they just classified the bonds as HTM. Ta da! Problem “solved.”

At the end of 2022, Silicon Valley Bank had almost 80% of its investments classified as HTM (that is, $91B or 78% of its investments are HTM and $26B or 22% are AFS). Prior to COVID only 30% to 50% were classified as HTM.

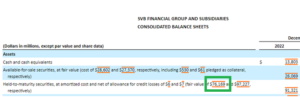

By the end of 2022, Silicon Valley Bank had $15B in unrealized losses on their HTM portfolio. The table below shows $91B in HTM securities with a fair value of $76B (highlighted in green) meaning that if they had to sell their portfolio at today’s prices it was only worth $76B.

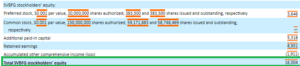

They couldn’t afford to move or sell anything out of their HTM portfolio, because they would have had to re-value large parts of it, which would almost wipe out the bank’s equity (the $16B highlighted in green below).

Now, that might not have been a problem if deposits had kept growing. But here we run into the second problem SVB had. The bank did not have a diversified customer base. It catered to start-up and early-stage venture capital-backed companies. These companies generally lost money (as is normal for start-ups) and they all shared common investors (the big VC funds). In fact, around half of all venture capital- backed start-ups banked with SVB. There was absolutely no customer diversification. As would be expected once the COVID era stimulus programs ended and the start-up funding market cooled down, companies began to draw down their bank accounts to fund their normal operating costs.

As deposit growth slowed at SVB and the bank’s securities portfolio lost money, the venture capital fund managers realized that the bank wasn’t on the safest footing. A lot of their portfolio companies had balances above the $250,000 FDIC insured limit. So, they did the prudent thing and told their portfolio companies they should move their accounts to a sounder bank. What happened on that Wednesday, Thursday, and Friday was over half of SVB’s deposit base pulling their money. SVB obviously could not cover those withdraws without selling HTM securities and becoming insolvent. Hence, by Friday the FDIC stepped in and seized the bank.

We can see that the problems with SVB didn’t have to do with macro-economic problems or loan quality. They had to do with SVB not having a diversified customer base and making bad investment decisions by prioritizing short-term profit and then attempting to paper over their losses by using some legal accounting maneuvers, which further increased their risk.

2023 Outlook

Things are continuing to slowly improve with inflation growth trending down. As I said in the last newsletter I think we will see the market recover when inflation returns to the 2-3% target rate and the Fed stops hiking rates. So far, we do not see anything worrisome economic signs with job growth and consumer spending still going along fine (particularly the job market). While goods spending is down it’s been more than made up for with services spending. Corporate earnings season has just started as of this writing so not many companies have reported results but what we’ve seen so far hasn’t raised any alarms (and has been better than expected).

2023 Performance

For the start of 2023 all returns were positive.

US Stock Market: 7.16%

Foreign Developed Market: 7.77%

Emerging Markets: 3.62%

US Total Bond Market: 3.28%

International Government Bonds: 3.41%

Investment Grade Corporate Bonds: 3.85%

Inflation Protected Bonds: 3.48%

Real Estate: 1.76%

(All the returns listed are those of the ETFs we use.)

Because all client portfolios are individuals your portfolio will contain a combination of most or all the investments listed as well as others, so its performance will be different. Please see your statements for your exact portfolio details.

There have been no changes to my personal investment portfolio, the chart will reappear in next quarter’s newsletter when it returns to the traditional two column format. This quarter’s letter is in single column format so the Silicon Valley Bank financial statement graphics would be readable.

Reminder

Although you are all familiar with my investment management and retirement planning services, I want to take time in this newsletter to remind you of the other financial services I offer.

These services are available to clients as part of their comprehensive fee. I work with clients to build monthly budgets, help pick the best credit card offer, and give advice on their existing company retirement plans. Almost anything related to finance or money is something I’m available to help you with. I’ve even helped clients with non-financial things, such as picking out a new car. I enjoy helping clients, so please do not hesitate to give me a call. Shoot me an email or text if there is any way I can be of assistance.

Sincerely,

Performance Disclosure:

The performance data presented prior to 2011 represents a composite of all discretionary equity investments in accounts that have been open for at least one year. Any accounts open for less than one year are excluded from the composite performance shown. From time to time clients have made special requests that SIM hold securities in their account that are not included in SIMs recommended equity portfolio, so those investments are excluded from the composite results shown. Performance is calculated using a holding period return formula, reflects the deduction of a management fee of 1% of assets per year, and reflects the reinvestment of capital gains and dividends.

Performance data presented for 2011 and after represents the performance of the model portfolio that client accounts are linked too, reflects the deduction of management fees of 1% of assets per year, and reflects the reinvestment of capital gains and dividends.

The S&P 500 and Dow Jones Developed Market Index are used for comparison purposes and may have a significantly different volatility than the portfolios used for the presentation of SIM’s returns. The term “global stocks” refers to the Vanguard Total World Stock ETF (VT).

A copy of our most recent Form ADV Part 2A and Part 2B is available upon request.