2021Q4 Quarterly Client Newsletter

Dear Clients,

With the market starting the year down over interest rates, inflation, and the situation in Ukraine I think it’s important to again remember what to expect in the stock market. In a roughly average year in the stock market you should expect the market to have a few drops of 3-5%, be down for the year at at least one point, and have one 10%+ drop. But, despite all that the market finishes up on average 9-11% for the year.

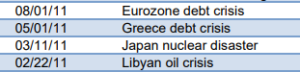

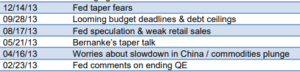

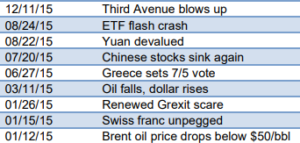

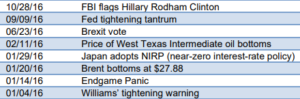

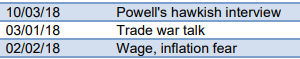

It can be hard to keep this in mind when the market is dropping and down a few percent in a day as whatever the current panic is dominates the news headlines. However, when we look back at what we are worried about, it seems silly. Since the recovery in 2010 the following is what has spooked the market. Despite all of these events the market has been up hundreds of percent since the 2009 lows! (Charts source: https://www.yardeni.com/pub/sp500panicattacktable.pdf)

2010

![]()

2011

2012

2013

2014

2015

2016

2017

![]()

2018

2019

![]()

2020

![]()

2021

![]()

Keeping Your account safe

In other non-market and economic news, it seems that there are always new types of online scams appearing and recently I’ve become aware of a one that is a more sophisticated than most and dangerous. While the scam generally targets law offices, escrow services, and real estate offices it got me thinking about how important cyber security is and how it might be helpful to let clients know the steps that I take to keep information and accounts secure and what you, the client, can do to protect your accounts.

This new type of scam works if hackers are able to gain access to email communications of a firm. They then wait until there is some type of financial transaction happening where the firm has given legitimate instructions to a client to send money (usually a wire transfer) to a legitimate account. Then usually during off hours such as the evening, weekend, or holiday the hackers will send a spoofed email (or if they have access to the firms email accounts an email actually from the firm) telling the client that there was some issue with the previous instructions and give them a new account (controlled by the scammers) to wire money too.

I thought it would be good to let you know steps that I take to protect client finances in case they are a target and steps you can take incase my business is ever targeted.

Here’s what you can do to keep your money safe in case you ever receive a suspicious email that looks like it’s from me. The easiest thing to do is make sure you only ever send money to your account and the custodian (FOLIO, TradePMR, or Schwab) of the account. Never send anything to me or made payable to me or any other third party.

The Only Way to Write a Check

Always make sure the only things appearing in the payable line of a check are your name, your account number, and the custodian or clearing service. You should never write a check out to me, my company, or any other third party. FOLIO Institutional and Charles Schwab both operate their own clearing services so if your account is at FOLIO checks should be made payable to “FOLIO Institutional” and for accounts at Schwab “Charles Schwab & Co.”. TradePMR uses Wells Fargo Clearing Services so checks for TradePMR accounts should be made payable to “Wells Fargo Clearing Services”.

Verify the Mailing Address

In addition to making a check out to a third party many scams also have you send the check or money to some other location. In this day and age it’s easy to rent a PO Box or a vanity mailing address at a respectable looking office park that looks like a real business address.

If you are mailing a check, make sure that the address where the check is going is the address of custodian that handles your account. You can use Google Maps/Street View before mailing any sensitive information to double check the address is correct. I actually use this method if a client changes their address online and would ask me to mail them something.

If you have an account at FOLIO, you should see the building below, their main office building, when you Google their address.

8180 Greensboro Drive 8th Floor McLean, VA 22102

If your account is at TradePMR, you should see their office building below, when you Google their address.

2511 NW 41st St Gainesville, FL 32607

For clients with accounts at Schwab, most document including checks are sent to their East coast document processing building which is shown below.

Charles Schwab & Co., Inc. Orlando Operations Center 1958 Summit Park Drive, Suite 200 Orlando, FL 32810

If the address is a PO Box you can Google that address and the results in Google search should be for the custodian of your account. For example, Googling Schwab’s PO Box address brings up page after page of results having to do with Schwab.

How I Keep Client Accounts Secure

You may also be wondering how I keep client information and accounts secure. You’ll be relieved to know there are many safeguards in place. First, all of the software I use to manage client accounts requires two factor authentications. Meaning after I enter my password I have to then enter another secret number that is sent to me or generated from a secure device (these investment letters are public so I’m not sharing the exact details).

In addition, we do not maintain any standing third party funds transfer authorizations. This means that no accounts have links to other third party brokerage or bank accounts (e.g. client accounts only have bank account links to their own bank accounts, not a third parties). The worst a hacker could is just move your money between your own accounts. There are also other fund transfer safeguards that the custodians have such as verifying large transaction amounts by phone and not mailing checks to new address for 15 days.

Investment Performance for 2021

For 2021 all stock market segments posted positive returns with US stocks leading the way. The US stock market returned 25.72%, Foreign Developed Market stocks returned 11.49%, and Emerging Market barely eked out a gain at .96%.

By contrast most bond markets were slightly negative for the year with the exception of inflation protected bonds. Finally, real estate had a banner year with 40% returns!

US Stock Market: 25.72%

Foreign Developed Market: 11.49%

Emerging Markets: .96%

US Total Bond Market: -1.85%

International Government Bonds: -2.20%

Investment Grade Corporate Bonds: -1.46%

Inflation Protected Bonds: 5.68%

Real Estate: 40.38%

(All the returns listed are those of the ETFs we use.)

Because all client portfolios are individuals your portfolio will contain a combination of most or all the investments listed as well as others, so its performance will be different. Please see your statements for your exact portfolio details.

Reminder

Although you are all familiar with my investment management and retirement planning services, I want to take time in this newsletter to remind you of the other financial services I offer.

These services are available to clients as part of their comprehensive fee. I work with clients to build monthly budgets, help pick the best credit card offer, and give advice on their existing company retirement plans. Almost anything related to finance or money is something I’m available to help you with. I’ve even helped clients with non-financial things, such as picking out a new car. I enjoy helping clients, so please do not hesitate to give me a call. Shoot me an email or text if there is any way I can be of assistance.

How is Ben Invested?

Here is how my personal portfolio (my SEP IRA at FOLIO Institutional) is positioned for 2018.

My investment breakdown is as follows:

- 31% in our Capital Appreciation Folio

- 32% in our Concentrated Stock Folio

- 31% in our Aggressive Growth ETF Portfolio

- 1% in Real Estate (Vanguard Real Estate Index, VNQ)

- 1% in Emerging Market Stocks (Vanguard Emerging Market Index, VWO)

- 1% in Investment Grade Bonds (Vanguard Total Bond Market Index, BND)

- 1% in Inflation Protected Bonds (Barclays iShares TIPS Index, TIP)

- 1% in Municipal Bonds (iShares S&P National AMT-Free Municipal Bond Index, MUB)

- 1% in International Investment Grade Bonds (Vanguard Intermediate Term International Bond Index, BNDX)

As you can see, I have a stock-heavy portfolio. I believe our strategies for investing offer the best opportunity for long-term wealth creation.

Note: I also have an older IRA account opened during grad school. That account is invested in one stock, Philip Morris International (PM).

Sincerely,

Performance Disclosure:

The performance data presented prior to 2011 represents a composite of all discretionary equity investments in accounts that have been open for at least one year. Any accounts open for less than one year are excluded from the composite performance shown. From time to time clients have made special requests that SIM hold securities in their account that are not included in SIMs recommended equity portfolio, so those investments are excluded from the composite results shown. Performance is calculated using a holding period return formula, reflects the deduction of a management fee of 1% of assets per year, and reflects the reinvestment of capital gains and dividends.

Performance data presented for 2011 and after represents the performance of the model portfolio that client accounts are linked too, reflects the deduction of management fees of 1% of assets per year, and reflects the reinvestment of capital gains and dividends.

The S&P 500 and Dow Jones Developed Market Index are used for comparison purposes and may have a significantly different volatility than the portfolios used for the presentation of SIM’s returns. The term “global stocks” refers to the Vanguard Total World Stock ETF (VT).

A copy of our most recent Form ADV Part 2A and Part 2B and Privacy Policy is available upon request.