2024Q1 Quarterly Client Newsletter

April 2024

Dear Clients,

For the start of 2024 global stock markets continued their gains however during the month of April the market dropped about 4% from its 2024 high point and as of this writing is up only about 6%, with international stocks up only about 4% and emerging markets up just shy of 2%.

As I’ve repeated in numerous newsletters it’s important to remember that these ups and downs are normal. In the average year you should expect the market to be negative at some point (we already had this to start the year), the market to drop at least 3% a few times, drop at least 5% at least once, and most likely drop 10% at some point. All of these drops are what normally occurs in a year the market finishes up.

With that being said let’s again take a look at the market and economies number one concern, inflation.

Inflation

We’ve seen core inflation rates drop to an annualized rate of 2.5% to 4.5% depending on what measure you use.

While this is still above pre COVID levels and probably still higher than what many (most?) consumers would prefer it has now fallen low enough that two important things for continued stock market and economic growth.

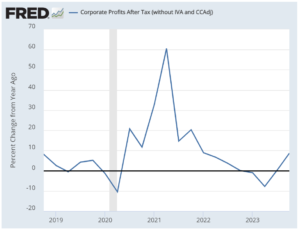

First, inflation is low enough that corporate profits have started growing again. This past quarter was the first quarter where we saw strong profit growth return. While corporate revenue grew every quarter after the initial COVID downturn, high inflation cut into corporate profits giving us almost a year of no profit growth. This is the main reason it took so long for the market to recover.

Second, inflation growth has now dropped below average wage growth. This means that workers paychecks are now more than compensating for price increases. While inflation may still be higher than we like it’s not eroding purchasing power on average.

However, while inflation has come down from the highs, we have started to see the rate it’s falling slow and have even seen it flatline. It’s likely that while it will continue to go down the journey will be slow for several reasons

Inflation Outlook

Inflation is likely to fall only slowly for several reasons.

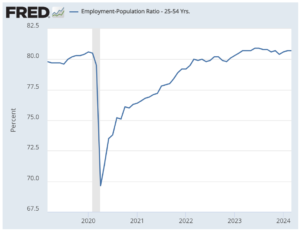

First, we there is not much slack in the labor market left. Prime age, that is workers aged 25-54 years old, employment has returned pretty much to pre-COVID levels. There simply aren’t a lot of unemployed people that there to hire.

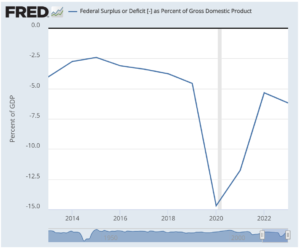

Second, is the Federal government budget deficit. During COVID we saw a variety of economic stimulus programs designed to prevent a repeat of the great recession (and while they certainly weren’t perfect, they did work). As things returned to normal however, the budget has not. Prior to COVID the budget deficit was around 2.5% to 4%. We now sit at around 6% with the deficit projected to expand.

The deficit represents extra money going into the economy which, when the economy is at or near capacity as it is very close to now, can cause inflation. It’s certainly not at or near a level a “Venezuela type” hyper inflation scenario where we would need to panic but it just represents a headwind for inflation to come down quickly.

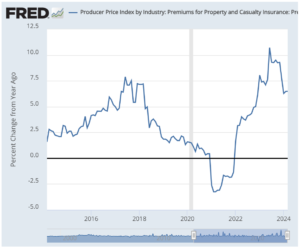

Third, there is a reasonable argument that higher rates actually cause high inflation in certain areas of the economy. For instance, many businesses finance their inventory and higher rates increases inventory carrying costs. Also, while not getting into the specifics, rising interest rates can cause problems with insurers investment portfolios leading them to need to raise rates to stay profitable. Indeed, we’ve seen auto and home-owners insurance rates grow at above average levels.

Finally, there are other things that can affect inflation rates at the margin. For example, the various proposals about forgiving student loans, especially if it results in large scale debt forgiveness can raise inflation. Now, this isn’t to say things shouldn’t be done about the affordability of higher education, this is just a commentary that forgiving debt means consumers will have more money to spend and thus any very large-scale programs could keep inflation from falling quickly.

To be clear, none of these are reason to worry about the market, the economy, or financial stability. They are simply reasons why inflation has not come down as quickly as the market and the Fed expected and why it’s prudent to be cautious about how fast inflation will come down in the future.

It’s also worth remembering that the long term inflation average in the US has been closer to 3% or 3.5% rather then the 1-2% we’ve experienced post 2009.

2024 Outlook

As long as inflation remains at a reasonable level, especially if wage growth equals or outpaces inflation growth the economy and the market should continue to do well. Corporate profits are growing again as shown below.

As long as that continues, the long term trend of stock market gains should hold despite the usual ups and downs along the way.

2024 Performance Review

For the start of 2024 all equity asset classes had positive returns for the first quarter. Stocks returned anywhere from 2% to 9% and bond returns were basically flat.

US Stock Market: 9.93% (now just up ~6%)

Foreign Developed Market: 4.46%

Emerging Markets: 1.75%

US Total Bond Market: -.72%

Short Term Bonds: 1.29%

International Government Bonds: .09%

Investment Grade Corporate Bonds: -.27%

Inflation Protected Bonds: -.07%

Real Estate: -1.22%

(All the returns listed are those of the ETFs we use.)

Because all client portfolios are individual, your portfolio will contain a combination of most or all the investments listed as well as others, so its performance will be different. Please see your statements for your exact portfolio details.

Sincerely,

Ben Strubel

Performance Disclosure:

The performance data presented prior to 2011 represents a composite of all discretionary equity investments in accounts that have been open for at least one year. Any accounts open for less than one year are excluded from the composite performance shown. From time to time clients have made special requests that SIM hold securities in their account that are not included in SIMs recommended equity portfolio, so those investments are excluded from the composite results shown. Performance is calculated using a holding period return formula, reflects the deduction of a management fee of 1% of assets per year, and reflects the reinvestment of capital gains and dividends.

Performance data presented for 2011 and after represents the performance of the model portfolio that client accounts are linked too, reflects the deduction of management fees of 1% of assets per year, and reflects the reinvestment of capital gains and dividends.

The S&P 500 and Dow Jones Developed Market Index are used for comparison purposes and may have a significantly different volatility than the portfolios used for the presentation of SIM’s returns. The term “global stocks” refers to the Vanguard Total World Stock ETF (VT).

A copy of our most recent Form ADV Part 2A and Part 2B is available upon request.