2023Q3 Quarterly Client Newsletter

October 2023

Dear Clients,

While the market is up for the year, it’s spent the last few months bouncing around as fears over Fed interest rate plans competed with generally good economic and inflation news. While it’s likely frustrating to still see account values below the 2021 high, zooming out and looking at the bigger picture can help alleviate some anxiety. Market returns from the beginning of 2019, 2020, and 2021 until now have been positive.

| From start of… | Market has returned |

| 2021 | 14.7% |

| 2020 | 33.2% |

| 2019 | 70.2% |

In fact, over the past four years and 9 months from the beginning of 2019 until now, the market has returned 70%! This is the main reason I have not been very alarmed at the down market.

What we had was well above average returns in 2019, 2020, and 2021 (31%, 18%, and 28%, respectively) while the market on average returns 10% per year. These returns were high enough that 2022 represented more of a return to average market growth expectations versus a huge loss of money that would permanently set back clients’ financial plans.

Inflation

On the economic front, inflation continues to trend down. Core inflation (which excludes volatile food and energy prices) has made new post-COVID lows in September.

One thing that may be confusing is that when we use the phrase “inflation is coming down” we are referring to the fact that inflation is growing less, not that prices are decreasing.

For example, if in August prices rose .2% and then in September rose .1%, economists would say “inflation is coming down” because prices rose less in September than in August despite the fact that prices went up each month.

This is why you may occasionally hear or read headlines talking about inflation falling yet when you go shopping you still see prices going up.

Right now, core inflation has fallen from an annualized rate over 8% to just above 4%. We should continue to see inflation come down as some important components like used car prices and rental rates have been falling or are set to fall.

Bond Market

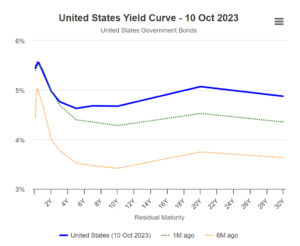

One of the most interesting things going on in the market right now is with interest rates and bonds. With bonds, you would expect the longer the term of the bond the higher the interest rate. You get paid more for taking on more risk by holding a bond longer. If you plotted time on the X axis and interest rates on the Y axis, called the “yield curve,” the chart would show a line going up and to the right.

However, right now we have an odd situation where short-term interest rates are higher than longer term rates, which you can see below (the solid, bold line is the current yield curve).

The Fed has raised short term rates above “normal” to combat inflation; however, the market knows that once inflation is down the Fed will likely lower rates. (The unlikely chance of a recession could cause the Fed to lower rates as well.) The bond market (along with almost everyone else) has consistently underestimated how long it will take for inflation to come down. You can see that in the dashed lines below, showing the yield curve one month and six months ago.

The Fed has been emphasizing the need to keep rates high until it is sure inflation has come down. It’s likely this will last longer than the market is expecting, and bond returns may be muted until the Fed starts lowering rates. Until then, we have a significant portion of client bond allocations in either individual bonds that we can hold until maturity (and are not affected by rates) or short-term bond funds.

Outlook for 2023 and Beyond

We haven’t seen much change with the economy this year. Job growth continues to be strong in the range of 250k to 300k per month.

Corporate earnings are finally projected to begin growing this quarter which, along with inflation continuing to fall, should help the stock market to finally recover back to its pre-2022 high water mark.

2023 Performance to Date

For 2023 all stock market returns continue to be positive so far. The US stock market led the way with a return of a little over 12%.

Bond market returns are now mixed with most barely above zero.

US Stock Market: 12.36%

Foreign Developed Market: 5.93%

Emerging Markets: 2.54%

US Total Bond Market: -.9%

International Government Bonds: 2.20%

Investment Grade Corporate Bonds: .52%

Inflation Protected Bonds: 1.09%

Real Estate: -5.40%

(All the returns listed are those of the ETFs we use.)

Because all client portfolios are individual, your portfolio will contain a combination of most or all the investments listed as well as others, so its performance will be different. Please see your statements for your exact portfolio details.

Sincerely,

Ben Strubel

Performance Disclosure:

The performance data presented prior to 2011 represents a composite of all discretionary equity investments in accounts that have been open for at least one year. Any accounts open for less than one year are excluded from the composite performance shown. From time to time clients have made special requests that SIM hold securities in their account that are not included in SIMs recommended equity portfolio, so those investments are excluded from the composite results shown. Performance is calculated using a holding period return formula, reflects the deduction of a management fee of 1% of assets per year, and reflects the reinvestment of capital gains and dividends.

Performance data presented for 2011 and after represents the performance of the model portfolio that client accounts are linked too, reflects the deduction of management fees of 1% of assets per year, and reflects the reinvestment of capital gains and dividends.

The S&P 500 and Dow Jones Developed Market Index are used for comparison purposes and may have a significantly different volatility than the portfolios used for the presentation of SIM’s returns. The term “global stocks” refers to the Vanguard Total World Stock ETF (VT).

A copy of our most recent Form ADV Part 2A and Part 2B is available upon request.