August 2023 Newsletter: Keeping Things in Context

It’s always important to view data in context. This is especially true with recent economic data as things have been normalizing after COVID-related extremes. You may see reports of huge swings in various economic data with breathless headlines about something doubling or tripling.

Let’s look at the following example to see why looking at the context is so important and how some of these attention-grabbing headlines can be misleading if not viewed that way.

Say some economic measure XYZ is at 100. Let’s also assume that 100 is its long-term average and its typical shorter-term level too. Let’s pretend the higher the number the worse it is (like a golf score). If, for example, measure XYZ doubled to 200, then that would be bad. Now, let’s pretend that two years ago, it fell 80% to 20. Then this past year it tripled, so it’s now at 60. You may read a headline “XYZ has tripled over the past year.” That headline and the word “tripled” would give you no larger context. It might be easy to become alarmed. But if you know 100 is normal, you can put that current 60 into context. A level of 60 is still below normal (which is good). No need to be alarmed.

As the effects of the COVID stimulus programs fade and the economy returns to normal goods-versus-services consumption levels, we should expect many economic measures will return near their pre-COVID levels. For example, as the stimulus measures wear off there is no reason we would expect credit card delinquency rates not to return to their normal pre-COVID levels. So, you might see a headline that over the past year credit card delinquencies have risen by 50%! This sounds scary if you don’t look at the context. In context, you understand delinquencies are simply returning to their normal post-COVID-stimulus rate. In fact, it’s actually technically still below it despite the 50% rise.

It’s the same story with credit card charge offs. (Delinquency rates are when people are late paying. Charge offs are when the loan is ultimately uncollectable.) You might read that credit card charge offs have skyrocketed by 50%. But they are still about half what they were pre-COVID. Again, a scary headline that is not truly scary when looked at in the proper context.

The same is true with household debt service payments. You might see headlines about households being more in debt, but they are still below pre-COVID levels.

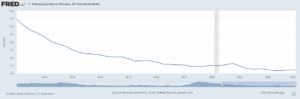

In other areas of the economy, things are still below COVID trends. It’s prudent, however, to keep in mind that there is a strong possibility these will begin to normalize in the future. For instance, commercial loan delinquencies are still near their COVID lows.

If rates start to normalize, you might see scary headlines like “Companies defaulting on loans at record rates!” or “Commercial loan delinquencies rise 50%!” If that happens, please keep in mind that merely means rates are returning to their normal levels.

When reading scary-sounding headlines, it’s important to remember to view things in context. You wouldn’t try to drive your car down the road while looking through a straw. You would want to see everything, the big picture, the context. Economic data is the same way. It’s always best to view the big picture.