March 2024: Inflation and Future Interest Rates

The biggest issue that continues to dominate the market is inflation and the path of future interest rate cuts. The Fed has said they will begin cutting rates this year. The market originally projected the Fed would begin cutting rates in March. Now, the market has pushed the consensus for the first cut back to June, and possibly later.

The Fed repeatedly has said the first interest rate cut will happen once they see “consistent evidence” that inflation is down into their target range. This criterion implies they are looking not just for one inflation reading in the range but two or more, depending on how they define “consistent.”

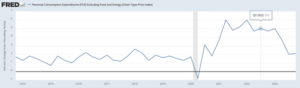

Core PCE (Personal Consumption Expenditures excluding Food and Energy) have come in right at the cusp of the Fed’s preferred range.

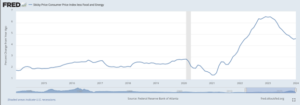

However, Core CPI (Consumer Price Index) is still elevated compared to pre-COVID, running a little bit below 5%.

The Fed’s preferred measure of inflation is Core PCE, so it’s likely that rate cuts will begin before CPI returns to pre-COVID levels.

For those curious about the differences between PCE and CPI, there are four main differences:

- CPI measures a defined basket of goods and services, while PCE attempts to reflect consumers’ substitution of goods. For example, if bread is expensive, then more consumers may eat rice instead.

- PCE contains more categories of goods and services. PCE’s main addition is the reflection of medical care provided by insurance plans, Medicare, and Medicaid, whereas CPI uses only out-of-pocket medical care costs.

- The goods and services category weights are different.

- The data sources are different. CPI data comes from household surveys, while PCE data comes primarily from business surveys.

There is plenty of (often heated) discussion over which is better. Since both measure different things in different ways, I think it’s best to look at both holistically. Both are valid ways to look at things. Consumers do substitute goods and services in real life (as PCE measures), and consumer are often upset when they see the price of something rising each week or month (as CPI measures) even if they are not buying that item.

While I believe that it’s likely the Fed will cut rates sometime this year, I think there is a good chance it may be later than some think. We continue to see strong job growth. Corporate profits have started growing again (which should also support hiring).

Perhaps the biggest issue for future inflation is something that’s rarely talked about: the deficit. The federal deficit represents the amount of new money being added to the financial system. Ordinarily, a small deficit is fine. (Without getting into the complex details, a small deficit this is normally needed to satisfy the private sector savings demand.) In times of recession, a larger deficit can help drive demand. (We saw the effects of this with the stimulus checks and PPP programs.) In times of an overheating economy, although rare, running a surplus (that is, removing money from the economy) can help cool inflation and demand.

Right now, the deficit is around 6% of GDP and projected to increase. Outside of the COVID pandemic, this is the highest the deficit has been since the post-Great Recession years of 2010-2012.

We are continuing to keep clients’ bond allocations skewed toward shorter term bonds until we see the Fed all but announce a rate cut, since the strong economy and high deficit mean inflation risks are skewed higher. We are not saying inflation will not return to historical levels, but we do think it may take longer than the market is currently projecting.