Value Investment Focus

For the equity portion of clients’ portfolios we adhere to the basic value investing philosophy set forth by Ben Graham and Phillip Fisher and refined by Warren Buffett. We seek to purchase good businesses at cheap prices. Over the years numerous studies have time and time again shown that following value investing principles generates superior risk-adjusted returns.

OUR STOCK SELECTION METHODOLOGY

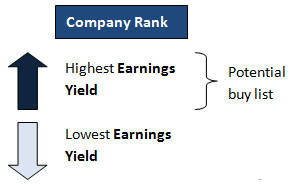

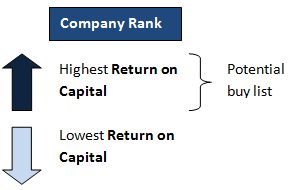

We make the vast majority of stock selections using a screening tool and portfolio construction method developed by Joel Greenblatt, a legendary value investor, hedge fund manager, and professor at Columbia University. Stocks are screened primarily by two variables, earnings yield and return on capital.

Only the top companies that rank the high in both earnings yield and return on capital are considered for inclusion in the portfolio. The equity portion of client’s portfolios will typically contain 40-70 stocks.

The companies can be further screened to select only those businesses with durable competitive advantages and sound financial health.