Time To Worry About Another Consumer Debt Bubble?

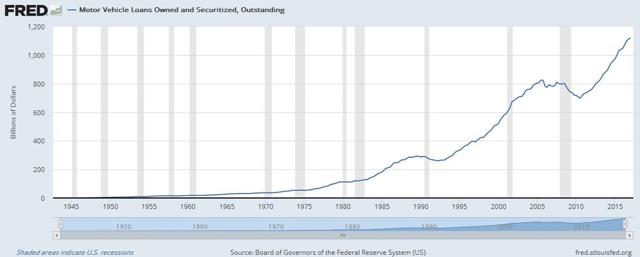

Recently I’ve started encountering more than a few articles warning about another consumer debt bubble forming. Most of the articles I’ve seen center around a possible bubble in the $1.1 trillion dollar auto loan market. With the amount of auto loans soaring and delinquency rates rising surely we must have another credit bubble on our hands that is about to burst. However, I do not think this is correct.

To be sure we do have a large amount of auto loans outstanding. The graph below, taken from the Federal Reserve’s Economic Data website, shows auto loans reaching an all-time high.

On top of that auto loan delinquency rates are rising and have reached their highest post-crisis rate. Indeed, delinquency rates are even increasing among prime borrowers. But a lot of the fear mongering over the auto loan sector lacks context.

You can read the rest of the article on SeekingAlpha.com by clicking here.